Investing in fintech: a market-first approach

At VEF, we make investment decisions driven by the unique dynamics of each market. Learn more from our CEO in this video.

At VEF, we make investment decisions driven by the unique dynamics of each market. Learn more from our CEO in this video.

Our financial report for 4Q24 is now published.

Investing in emerging markets requires patience, resilience, and a long-term view. In this piece, our CIO shares key lessons on EM investing.

VEF Principal Evin Mc Kay shares insights into Brazil's real-time payments system, Pix, and the Central Bank's push to digitize financial services nationwide.

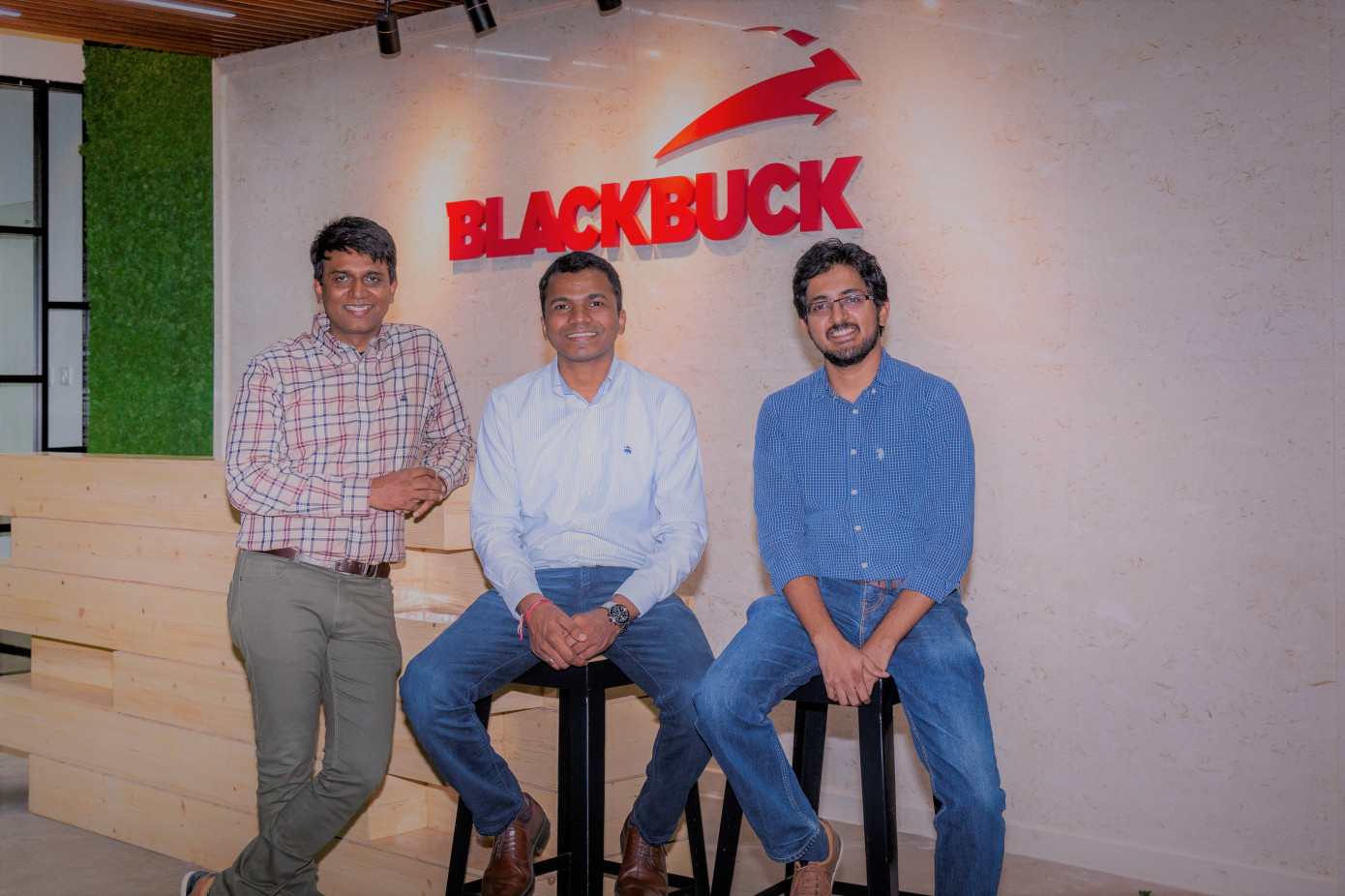

BlackBuck, a digital platform for truck operators and VEF portfolio company, has successfully completed an IPO in India. Learn more in our press release.

After recent trips to Mexico and Brazil, VEF principals Éire and Evin share key market trends and insights in this article.

Creditas has released their financial results for 3Q24, delivering origination growth of 17% QoQ and 49% YoY combined with expanding margins.

At VEF, we combine returns with real impact. In this video, Helena Caan Mattsson shares the tangible impact Konfío is making on SMEs across Mexico.

Sergio Furio, founder and CEO of Creditas, dives into his journey on LatAm’s top tech podcast, sharing how he built one of Brazil’s leading fintech powerhouses.