Active ownership and sustainable investing

VEF takes pride in the truly active ownership approach to investing we have. Our investment decision-making process is based on two core beliefs:

1. The power of active shareholding, to ensure strong governance and responsible business practices; and

2. Sustainability as a fundamental part of business.

Sustainable portfolio management starts with a robust investment process and even before we invest. We have an investment process backed by thorough sustainability and impact analysis and the investment team and Head of Sustainability work together on all investments to ensure that they live up to our sustainability standards both before we invest but also throughout the lifetime of the investment.

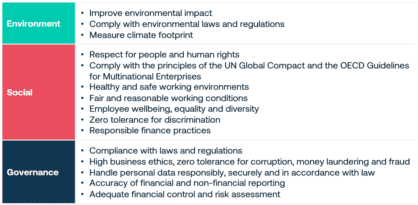

With our active ownership approach, we seize the opportunity to be a sustainability partner to our portfolio companies and ensure that our values and ethical principles are trickled down to them. We have set a minimum standard for all our portfolio companies with the VEF ESG Principles and VEF Responsible Finance Principles and require all portfolio companies to formally commit to these.

VEF ESG Principles

VEF Responsible Finance Principles

VEF’s Responsible Finance Principles are based on our mantra “If it’s not ethical, it’s not scalable” and we require all our portfolio companies to work in accordance with these.

- Provide responsible, fair, and transparent financial products.

- Have clear and understandable terms and condition.

- Work to prevent over-indebtedness.

- Provide accessible and clear customer service in a timely and responsive manner.

- Handle personal data responsibly, securely and in accordance with law.

- Promote digital financial literacy and awareness initiatives

Responsible and impactful investing

We divide our investments into two different sustainable investment categories: Responsible Investing and Impactful Investing. All our investments fulfill the criteria of being responsible investments, but according to our own definition they are not all impactful investments.

Impact - fintech as a force for good

VEF’s largest and most meaningful contribution to emerging markets is the positive impact the portfolio companies can have on society by providing access to financial products to consumers and MSMEs in these markets. VEF can make a difference by allocating capital to companies that contribute to development of society and the lives of consumers and MSMEs in the emerging world.

Fintech for financial inclusion, wellness and fairness

In large parts of the world, financial services for consumers and MSMEs are either unavailable, of poor quality and/ or discriminately expensive. 1.4 bln adults globally remain unbanked and many of those are in our core markets, including India, Pakistan and Indonesia. Fintech companies providing digital financial services, such as mobile wallets, electronic payments, fintech apps, digital credit services, etc. can reach people and businesses previously excluded from these services and can support positive change in emerging markets.

Fintech for the green transition

Improving access to renewable energy in emerging markets is key for the transition to a carbon-free society. As emerging markets are home to over 60% of the global population, and are expected to account for almost 80% of the global growth in electricity demand going forward (given increasing populations, economic development and rising incomes), it will not be possible to achieve net zero without including these markets. Fintech companies can play a pivotal role by unlocking access to financial solutions that allow and enable investing in renewable energy sources, particularly for consumers.

Policies

The Board of Directors of VEF adopts multiple policies on a yearly basis to ensure that the way we conduct business remains sustainable. Management has further implemented guidelines and practices to ensure compliance with VEF’s various policies and sustainability principles. The relevant policies, guidelines and internal practices have been comprised into one Sustainability Policy and a Responsible Investment and Shareholding Policy that you can find here:

Sustainability reports

Whistleblower

VEF is committed to be a company with highest business ethical standards. We expect all employees, as well as relevant third parties who deal with VEF, to come forward and voice all serious concerns about any aspect of VEF’s business. Anyone with a complaint can make an anonymous report here. Such report will be received by VEF’s legal and compliance function and will be forwarded to the Chairman of the Board or the CEO as appropriate. All reports will be handled confidentially. If you have any questions or would like to report orally, please contact legal@vef.vc.