Fintech in India

There are few countries that present a larger opportunity than India in our investment universe of emerging market fintech. Since our initial investment there in 2020, VEF has invested in three fintech companies in India – Juspay, Rupeek and BlackBuck.

India’s financial services landscape is characterized by highly competitive incumbents, a dynamic set of government initiatives and a proactive, protective regulator. These factors, alongside rapid growth in smartphone adoption and data usage, has led to the acceleration of financial inclusion and financial services penetration in the country, the creation of advanced infrastructure, and a thriving fintech environment.

The opportunity in payments

While cash is still the preferred mode of payment (standing at 60% of total payment volumes in 2020), India has been undergoing a rapid transition from cash to digital payments. Digital payments accounted for just 3% of total transactions in 2005, growing to 20% in 2015 and doubling to almost 40% in 2020. Government initiatives such as demonetization and the Unified Payments Interface (UPI) (a real-time interbank payment system) have played a large part in the growth and innovation of digital payments in India.

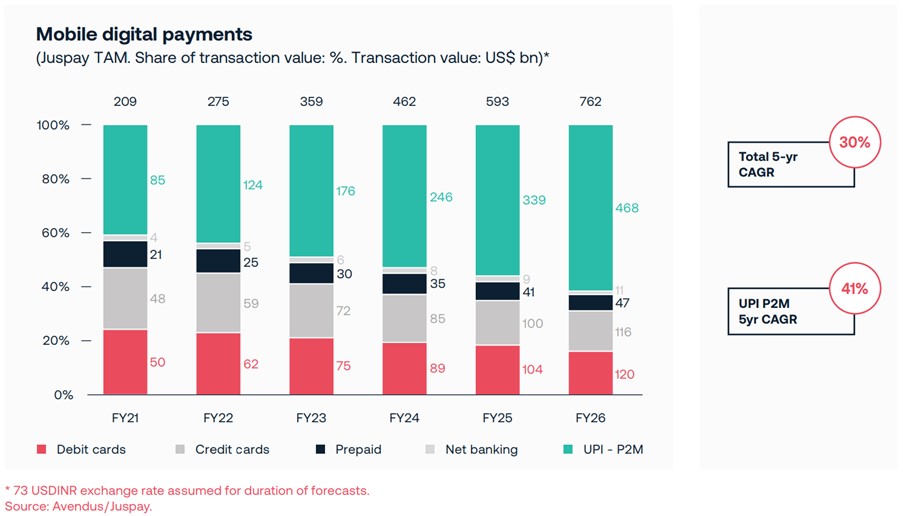

Mobile payments, including UPI, are the main drivers of this growth. UPI ‘pay to merchant’ mobile payments are the fastest growing portion of the overall payments market, estimated to experience 41% CAGR between 2021 and 2026, surpassing the market’s overall 30% CAGR during the same period.

The rapid growth, complexity, and thin pricing of payment services in India presents massive opportunities for fintechs, where our portfolio company, Juspay, operates.

Our investment in Juspay

VEF led Juspay’s Series B round in 1Q20, investing USD 13m in the business. We also participated in Juspay’s Series C funding round in 4Q21, which raised a total of USD 60mln led by Softbank.

Juspay offers an intelligent technology platform which unifies payment gateways and increases payment conversion rates, playing a pivotal role in improving the user experience for billions of payment transactions for leading merchants like Amazon and Flipkart. The company’s strong value proposition of removing payment friction and delivering strong product innovation has set Juspay up for rapid growth. Today, a large proportion of India’s mobile payments go through Juspay, processing over 30 mln transactions every day.

To learn more about the Indian payments opportunity and our investment in Juspay, read our long-form research piece on the topic here.